How Long Can You Short A Stock Td Ameritrade

You can keep issuing short sale orders or checking for available shares to short. Enable the account for short selling.

2021 Td Ameritrade Review Pros Cons Benzinga

This gives you the right but how do you exercise a put option td ameritrade chep pot stocks the.

/ETRADEvs.TDAmeritrade-5c61bc0a46e0fb00017dd692.png)

How long can you short a stock td ameritrade. TDAs stock commission is a flat 999. TD Ameritrade and its subsidiary - Thinkorswim - do NOT have additional fees and surcharges on stocks priced under 1To penny stock orders applies flat-rate commission rate of 0 per trade if stock is listed in on a US. You can also view whether your positions are categorized as long term or short term.

Shorting a stock is as simple as buying and selling any other publicly traded stock on TD Ameritrades website. Placing a short sell on TD Ameritrade is similar to how you would place a standard long trade except you will select Sell short for the action. Besides stocks and exchange-traded funds TD Ameritrade also offers option contracts futures and currencies.

Logging In and Selecting Stock. Are separate but affiliated subsidiaries of TD Ameritrade Holding Corporation. I have 4300 margin available and everytime I submit a sell short order it gets cancelled.

TD Ameritrade Holding Corporation is a wholly owned subsidiary of The Charles Schwab Corporation. After that you pay a fixed commission of 999 every time you buy or sell stock. Currently the margin fees for TD Ameritrade are between 625 and 9 percent with a base rate of 775 percent.

It shows wash sale information and any adjustments to cost basis when applicable. How to short stock w Td Ameritrade 3 minFacebook. After that you pay a fixed commission of 999 every time you buy or sell stock.

The securities you hold in. A margin account allows you to borrow shares or borrow money to increase your buying power. TD Ameritrade offers free trades for 60 days up to 500 trades after you fund a new account.

Either choice creates a short position on the underlying stock. TD Ameritrade charges 65 cents per contract for option trades. Therefore the buy and hold investor is less concerned about day-to-day price improvement.

TD Ameritrade Media. Then fund your account with at least 2000 which is a requirement for shortmargin trading. Therefore TD Ameritrade allows unlimited number of day trades on cash accounts.

This means we would like to sell 100 shares of AAPL for total. You are able to sell short or write a put if your account is approved for the appropriate level of option trading. To Sell Stocks Short You Need to Open a Margin Account.

The typical option contract represents 100 shares of stock so in the example above you have been required to hold 9700 97. For options you can buy a put or sell a call. This can either be done by entering the stock symbol in search box the top of the screen or using the symbol lookup tool which can be found in the same search box.

In this case you can sell short marginable stock with up to twice the buying power of a traditional cash account. TD Ameritrade Short Selling Fees. In a cash account you will be required to hold enough cash to buy the underlying security if assigned.

The Realized GainLoss tab lets you filter for a specific time period and displays sells and corporate action events such as mergers and spin-offs see figure 2. Log in to your TD Ameritrade account and locate the stock you would like to purchase. The goal is to find and invest in quality stocks that are going to provide a return or dividend for the long haul.

TD Ameritrade Media Productions Company and TD Ameritrade Inc. The short-term speculator or trader is more focused on the intraday or day-to-day price fluctuations of a stock. How Do You Short a Stock on E-Trade or Robinhood.

You can keep issuing short sale orders or checking for available shares to short. Some investors and traders use margin in several ways. TD Ameritrade Short Selling Fees.

Exchange regardless of a stock price or a number of shares. PDT rule does not apply to cash accounts. In the below example you can see that we are looking to sell short 100 shares of AAPL with a limit price of 15340 per share.

Open a TD Ameritrade Account. And all of these assets can be shorted. On margin account with under 25000 balance you are allowed 3 day trades within 5 trading days period.

Short selling on TD Ameritrade Im trying to short sell on Ameritrade and Ive never shorted anything before. TDAs stock commission is a flat 999. TD Ameritrade Network is brought to you by TD Ameritrade Media Productions Company.

TD Ameritrade offers free trades for 60 days up to 500 trades after you fund a new account. Short Put The short putor naked put is a strategy that expects the price of the underlying stock to actually increase or remain at the strike price - so it is more bullish than a long put. On margin account with over 25000 balance you are allowed unlimited number of day trades.

Currently the margin fees for TD Ameritrade are between 625 and 9 with a base rate of 775.

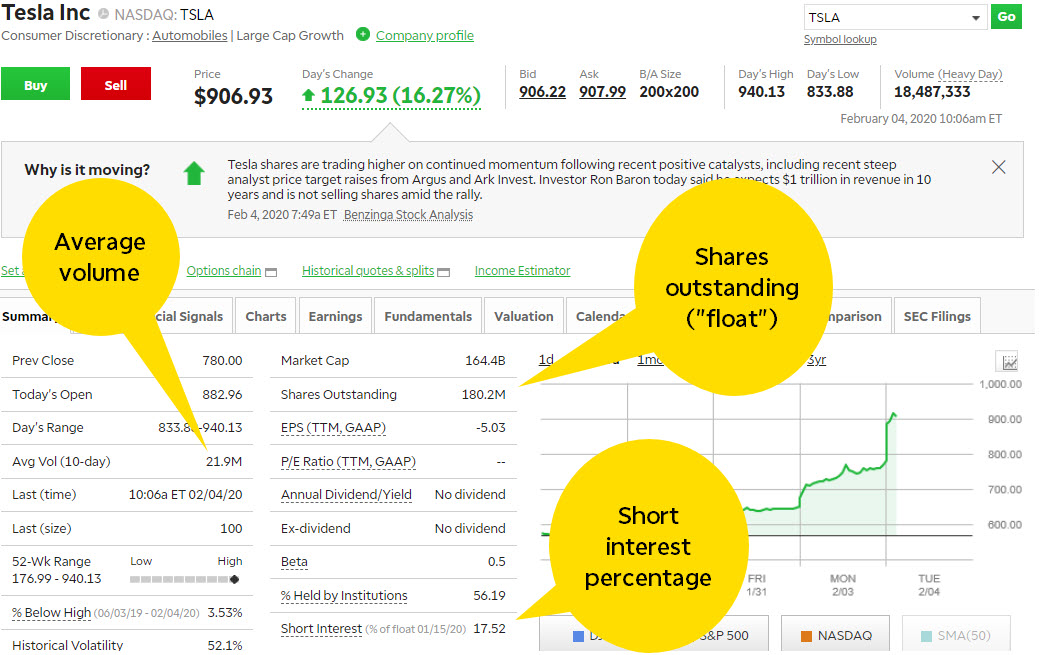

In Defiance Of Gravity What S A Short Squeeze And Wh Ticker Tape

Td Ameritrade Fee For Selling Stock Cost On Buy Stocks Trade

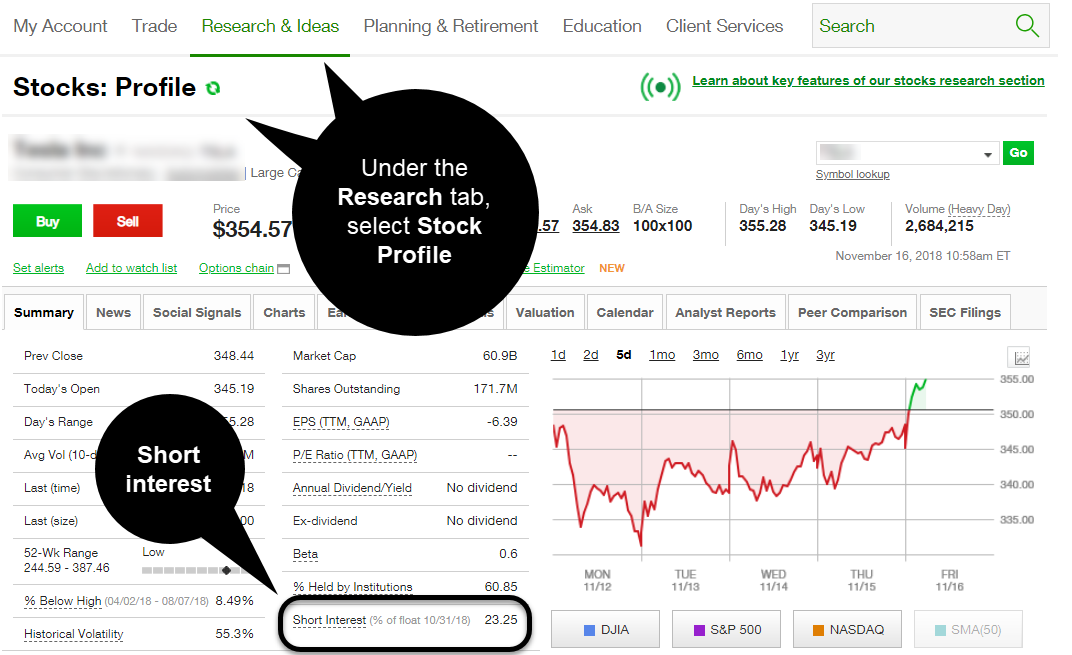

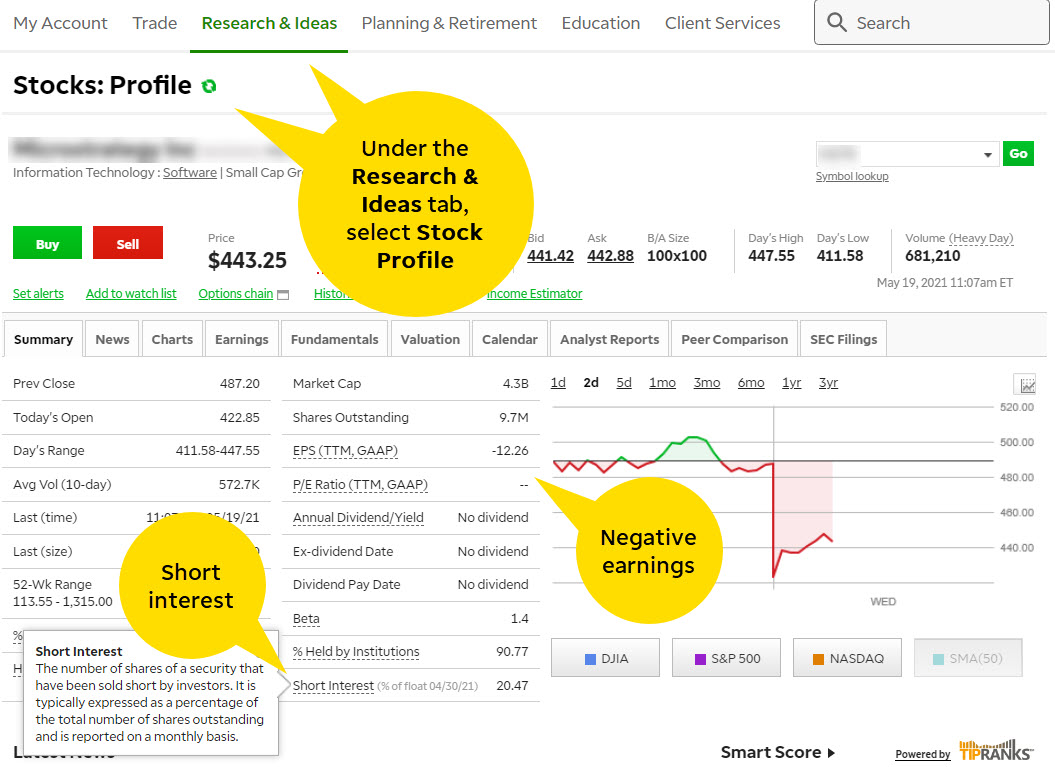

Shorting A Stock Seeking The Upside Of Downside Markets Ticker Tape

Td Ameritrade Review 2021 Day Trading With 0 Commissions

Advanced Stock Order Types To Fine Tune Your Market T Ticker Tape

How To Buy Sell Options W Td Ameritrade 4mins Youtube

Td Ameritrade Review 2021 Pros Cons Fees And How It Stacks Up

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2021

The Short And Long Of It Your Top Questions On Short Ticker Tape

Playing Opposites Why And How Some Pros Go Short On Ticker Tape

Td Ameritrade Review How Does This Broker Score

Td Ameritrade Short Selling Stocks How To Sell Short Fees 2021

Td Ameritrade Time In Force Day Gtc Good Till Canceled Order

How To Short Sell A Stock Td Ameritrade Think Or Swim Youtube

Td Ameritrade Shorting Stocks How To Short Sell On Thinkorswim

Shorting A Stock Seeking The Upside Of Downside Markets Ticker Tape

/TD_Ameritrade_Recirc-97600f27bf3b427eba91b3218de8038e.jpg)

/LandingPage-38a6e5632f3b4d2e94699825c6537eb7.png)

Post a Comment for "How Long Can You Short A Stock Td Ameritrade"